If you read some of the press you’d might think the interest in electric cars has peaked. Some of the press, especially on the right (Wall St. Journal, The Hill), are already predicting the demise of EVs. But that’s all mostly political and bears nothing close to the truth.

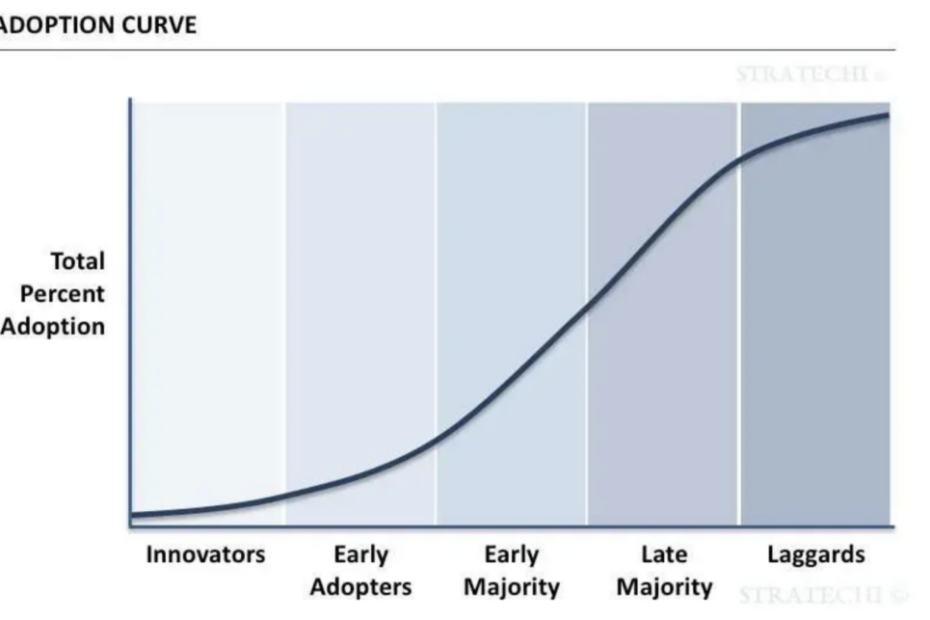

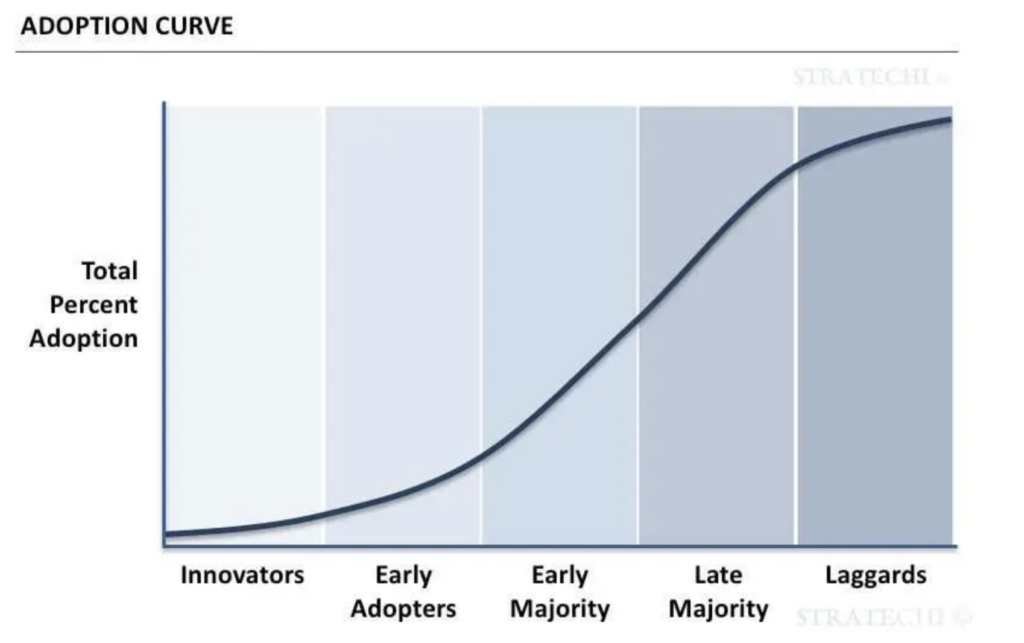

The adoption curve of new products is rarely linear or exponential. It usually has several inflection points. Right now we are approaching one of those points between Early Adopters and Early Majority that is made up of several factors. First, the growth of the market leader Tesla, who once had 100% of the market, is stalling, and it’s upcoming quarter may be one of the worst in terms of year over year growth.

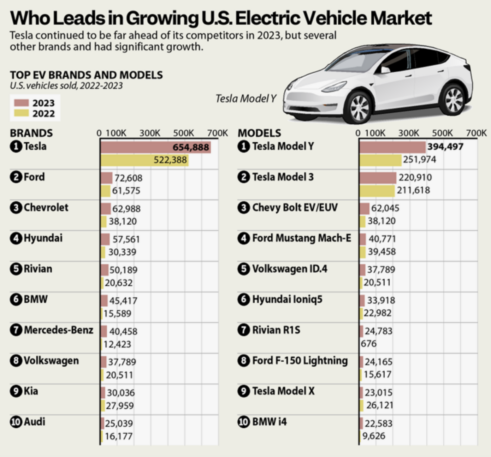

While Tesla unit sales have grown about 50% per year until last year, last quarter sales grew just 20% year-over-year, and some now think the next quarter might be flat or even down. If you look at Tesla’s own statements, they say they’ve had a cumulative production of 6 million cars to date. From the company’s historical data, Tesla reported sales of 5.57 million cars from inception as of 12/31/23. This implies Tesla produced 430,000 cars in Q1’24, down 13% from 495,000 cars in Q4’23.

Since Teslas has 60% of market share, the slowdown in Tesla sales has contributed to the major reduction in overall EV sales, but masks some of the large increases experienced by the many new entrants. BMW for example grew its EV sales by 48% year over year.

Slowing sales at Tesla are the result of a number of factors that have nothing to do with EVs. Tesla CEO Elon Musk has made no friends with his bizarre behavior, admitted drug use, and support of right wing and Nazi propaganda, turning off many potential buyers. His cars have not changed in their basic design in over eight years, something no normal car company could tolerate. As for his Cybertruck, that’s more of a vanity project that’s not of interest to most car buyers. So Tesla is about to begin a tailspin, much of it self-inflicted.

The other contributions to slower sales are the stumbles GM and Ford have made with their EV strategy. GM in particular first canceled and then restarted the Chevy Bolt, one of the best selling, least expensive EVs. Then they stumbled with the introduction of the Chevy Equinox that had catastrophic quality issues with its electronics. Ford in their exuberance, overpriced some of their models and are now making corrections across the board.

Forecasters expect 2024 to provide good overall growth following a strong 2023 with 1.19 million all-electric cars sold, up 46% from the prior year, according to Cox Automotive. “EV sales are increasing faster than any other segment in the industry,” said Michelle Krebs, executive auto analyst for Cox.

There are now more than a dozen manufacturers of EVs, all of whom are bringing out multiple models with a wide variety of body styles to offer something for everyone. There’s even a new 3-seat SUV from Kia that’s heavily backordered. The choices have never been as broad as they are today.

2024 looks to be a strong year with EV sales expected to be 10% of car sales.

Like most new products, initial models are premium priced to gain sales from early adopters willing to pay more to be first. As new models arrive, competition increases, prices drop, and new lower cost models are introduced. The cycle is predictable and happens with all consumer products where there are multiple players.

The adoption curve for EVs is following the same curve we had for large screen flat TVs, where batteries can be compared to flat display panels. Each constitute the largest cost element in their respective products and both continue to drop in price through manufacturing efficiencies and technical advancements.

Initially a 50-inch plasma TV cost $5000 for a couple of years, then began to drop in year 3 to $2500 for LED TVs. As new manufacturers and cheaper technology came on line, we see prices now as low as $400 for even better performing sets. The same is beginning to happen with battery technology.

Inherently, an EV is a vastly simpler car to manufacture and much less expensive to own than a gasoline powered one. As the cost of batteries fall, we will eventually see EVs costing significantly less than internal combustion engines cars.

A lot has been written in the press attributing slow sales caused by a lack of a widespread charging infrastructure. That has created fears among the public, but much of that is unwarranted, since nearly 90% always charge their cars on a home charger. To counter that concern, some car companies are offering a free loaner car for long trips to alay any fears.

The shift to electric vehicles will continue with a few bumps, but based on the 2023 sales and 2024 forecasts, we are entering the rapidly rising Early Majority phase where sales will accelerate, reach a plateau and level off once most of us have an EV.